Digital Credit

Smart Lenders AM began its activities with a focus on the selection and management of consumer credit portfolios acquired via online lending platforms, or marketplace lending, in the United States and then in Europe.

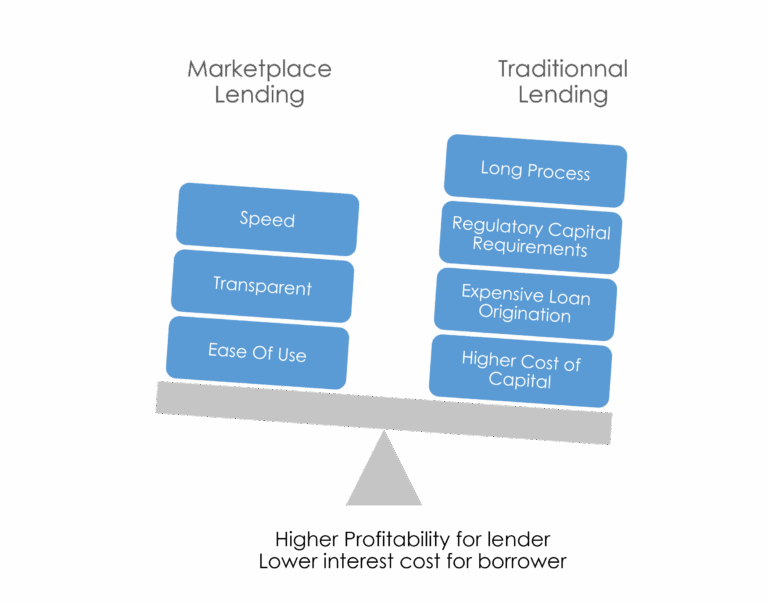

Marketplace lending is a concept that originated in the United States, with the disintermediation of banking and the technological evolution of connecting borrowers and investors via online lending platforms. It represents an innovative (and often more accessible) alternative to traditional lending. It is an innovative way to gain exposure to asset classes such as consumer credit and small business loans.

Number of loans financed by our investment vehicles:

Smart Lenders AM have recognized expertise in credit selection, acquisition and portfolio management. We have developed our own proprietary credit risk analysis model based on our research in Artificial Intelligence and Machine Learning. We use a quantitative and algorithmic approach in our loan selection process and the construction of our credit portfolios.

For investors seeking to diversify their portfolio exposure beyond traditional assets, marketplace loans can offer attractive, absolute, and risk-adjusted return characteristics with a low duration.

This asset class exhibited fundamental resilience through an adverse economic environment, such as the COVID 19 crisis partly thanks to its low correlation to other asset classes.

Structured Credit

Smart Lenders AM has extended its expertise in Europe to other types of “alternative” debt created by fintech, such as Buy Now Pay Later, Revenue-Based Financing, Merchant Cash Advances, Income Share Agreements, Asset Based Lending…

We believe that these new credit models offer multiple avenues for diversification and decorrelation from traditional fixed-income assets.

Our approach is based on rigorous analysis and careful assessment of market conditions and credit risk profiles, enabling us to select the best options for our clients’ specific needs.

We have recognized expertise in structuring and developing innovative investment structures and managing ultra-granular portfolios.

We leverage our proprietary technological tools to enable efficient management, comprehensive reporting, and real-time monitoring of fund performance.

As an AMF-approved asset management company with Full Scope AIFM status, Smart Lenders AM has “loan granting” approval, enabling it to directly finance VSE/SMEs in Europe and support the real economy.

Thanks to its expertise, its network of partners (advisors, custodians, delegatees, payment processors) and its various approvals, Smart Lenders AM offers tailor-made investment solutions combining portfolio management and financing.