WHAT IS MARKETPLACE LENDING ?

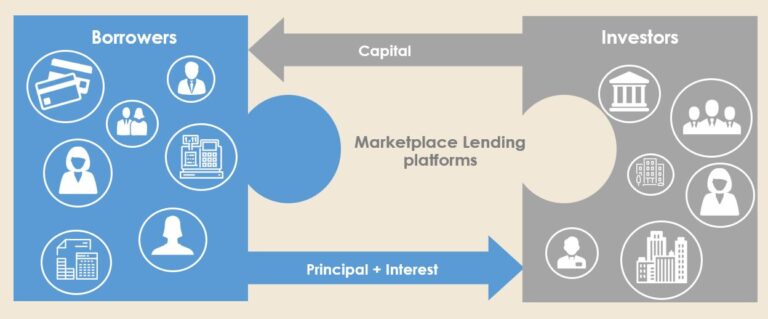

Marketplace lending is a concept whereby borrowers and investors (or lenders) are matched via online platforms.

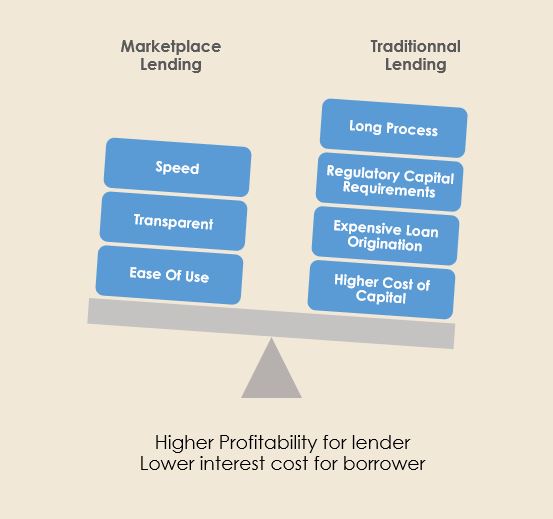

These marketplace lending platforms seek to simplify the traditional lending process by connecting borrowers and loan investors, using technological models to originate credit transactions. The business model, which originated in 2005 and is driven by financial technology, has taken a substantial market share from the traditional lending operations of the large commercial banks. It results in the disintermediation of more traditional financial institutions.

Through the emergence of e-commerce and big data processing, the online marketplace lending model has developed efficient and compelling ways to quickly assess and categorize borrower credit risk in a very granular fashion.

Platforms typically use multi-level credit and risk rating models to assess the creditworthiness of borrowers.

HOW DOES IT WORK ?

Focusing on high quality credit via a transparent and risk-based process, lending marketplaces allow borrowers to obtain loans with interest rates that are often lower than those offered by commercial banks or credit card providers.

These platforms enable lenders to acquire loans with interest rates and credit characteristics that can offer attractive net returns (after fees and defaults).

The platforms often charge fees to their lenders for the services provided, including screening borrowers for their eligibility and credit criteria, managing the supply and demand of the marketplace, and facilitating payments and debt collection (the “servicing”).

As a result, investors and borrowers on these lending marketplaces commonly share the margin that a traditional banking intermediary would normally capture.

AN ATTRACTIVE ASSET CLASS WITH 20 STRAIGHT YEARS OF POSITIVE RETURN

Marketplace lending is not a new investment; it is an innovative mean of gaining exposure to the consumer credit or small business loan asset classes.

Platforms have built their businesses on decades of open data, specifically on the one provided by major banks and credit card companies.

Marketplace loan is no different than credit line. Credit cards are a similar investment to a marketplace consumer loan.

THE EVOLUTION OF MARKETPLACE LENDING

Marketplace lending reflects a diversified opportunity set.

As the asset class matured, the volume and variety of strategies have expanded, beyond the unsecured consumer, to include small businesses but also new types of debt created by fintech such as Buy Now Pay Later, Revenue-Based Financing, Merchant Cash Advances, Income Share Agreements…

We believe these new types of debt provide multiple axes for diversification (e.g., by loan segment, credit quality, geography, size and loan duration).

BENEFITS OF THE ASSET CLASS

For investors seeking to diversify their portfolio exposure beyond traditional assets, marketplace loans can offer attractive, absolute, and risk-adjusted return characteristics with a low duration.

This asset class exhibited fundamental resilience through an adverse economic environment, such as the COVID 19 crisis partly thanks to its low correlation to other asset classes.